Prince George taxpayers with questions on property assessments are able to view an explanation from the City.

In a news release, they explained how the average of a 3 per cent property assessment increase doesn’t necessarily give them more money.

For expenses, cities determine annual costs for services, consider increases for things like inflation, and regulations from other levels of government

The cost of providing services typically goes up every year, meaning the City needs more funds to carry on.

For revenues, cities collect taxes based on property value (assessment) set by BC Assessment, which determines the taxpayers share of city expenses.

They said their finance division calculates the tax rate needed to raise exactly the specified revenue needed for the budget.

The tax rate, or mill rate, when multiplied by the total value of all the property in that class across the city, will equal the total revenue needed to be collected from that class of property.

As for the City’s break down, a town with a $100 million budget, and 40,000 homes valued between $200,000 and $2 million, would average at around $500,000.

They then find each home’s share based on their assessment, and if the total value of all homes is $20 billion, the City calculates a tax rate to cover the budget.

For example, if the rate is $5 per $1,000 of assessed value, a $500,000 home pays $2,500 in taxes.

If property values rise by 25% to $25 billion, the City recalculates the rate, but if a home’s value also rose by 25%, taxes remain at $2,500, as the city’s budget didn’t increase, and your property value increased by the average.

According to a report presented to City Council’s Standing Committee on Finance and Audit in December, City Council will be looking at a potential 6.55 per cent increase at budget meetings scheduled for later this month.

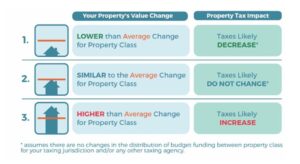

The City summarizes the break down, saying:

- Higher property assessments ≠ more City revenue

- Assessments split tax bills, don’t determine total tax

- Above-average increase = higher taxes

- Below-average assessment = potential savings

More information can be found on the City’s website here.

Something going on in the Prince George area you think people should know about?

Send us a news tip by emailing [email protected].